What is the size and composition of the unrecorded market? Combination approaches

What is the size and composition of the unrecorded market? Combination approaches

Combining Population-Based Surveys and Desk Research

A second combination approach is similar to the total consumption minus recorded supply approach described in Estimating the Gap Between Total Consumption and Recorded Supply. However, instead of relying on government data from household expenditure surveys to estimate total consumption, a population-based survey is designed expressly to measure consumption of unrecorded alcohol. This approach is recommended over those relying solely on official statistics where:

- reliable estimates of total consumption are not available;

- the composition of the unrecorded market, in addition to an estimate of its size, is desired; or

- one wishes to collect additional demand-side data, such as consumer perceptions of, and motivations for consuming, unrecorded alcohol products.

Combining Population-Based Surveys and Value Chain Analysis

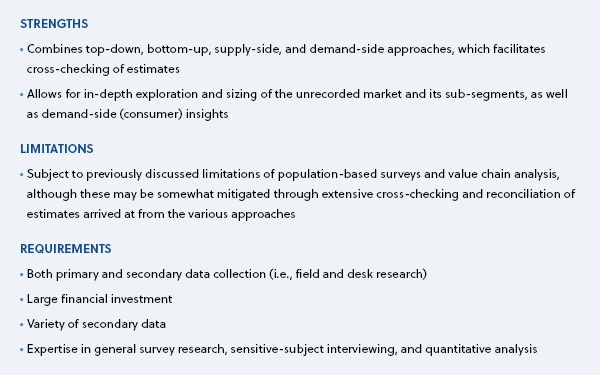

This approach combines expert interviews, store visits, and desk research (via value chain analysis) with a population-based survey ― typically a household survey ― tailored to investigate the unrecorded market. Here, data are collected from a combination of supply- and demand-side sources through both field and desk research, and all data are cross-checked. A unique strength of this approach is that it allows for in-depth exploration and sizing of the unrecorded market and its sub-segments from both the supply- and demand-side.