What is the size and composition of the unrecorded market?

field research approaches

What is the size and composition of the unrecorded market?

field research approaches

Expert and Key Informant Surveys

Expert and key informant surveys can also be used to estimate the size of the unrecorded market. In their simplest form, they involve simply asking individuals with extensive knowledge of the unrecorded market to provide an estimate of its total size. Alternatively, interviewees may be asked to provide estimates of, or other information about, the component parts of the unrecorded market, which are then pieced together to derive an estimate for the total market.

Expert surveys may include interviews with:

- government officials and authorities;

- members of the medical community;

- trade associations;

- NGOs; and

- academics.

They may also take the form of trade interviews with individuals located throughout the supply chain whose sales may have been directly affected by the presence of unrecorded ― and, particularly illicit ― products. Such individuals include:

- producers;

- importers;

- wholesalers; and

- retailers.

A particularly systematic approach to the use of expert opinion is the Delphi method ― a structured, iterative communication technique that asks a panel of experts to respond to questionnaires in a series of two or more rounds, with the goal of converging on a consensus opinion. The WHO currently uses this technique to generate estimates of unrecorded consumption in a number of countries that are included in the Global Information System on Alcohol and Health (GISAH).

Interviews may also be carried out with key informants involved in the production or distribution of unrecorded alcohol. Similar to interviews conducted as part of store visits, eliciting honest responses from key informants may prove difficult, and even dangerous, in some contexts.

Like expert surveys, key informant surveys may be used not only to estimate total unrecorded consumption but also to describe the composition of this market. Different types of experts and key informants will have different areas of knowledge and expertise. For example:

- legitimate producers and importers often have knowledge of the illicit market and can help to explain related fluctuations in the legal market;

- producers and distributors of unrecorded alcohol may be well positioned to estimate the size of the segments in which they are involved;

- customs agents may be useful in quantifying smuggled or contraband products, particularly in countries with weak enforcement or poor-quality data; and

- academics and researchers working in public health may be able to offer useful estimations for various segments of the unrecorded market, such as those for surrogate and artisanal beverages, depending on their specific expertise and experience.

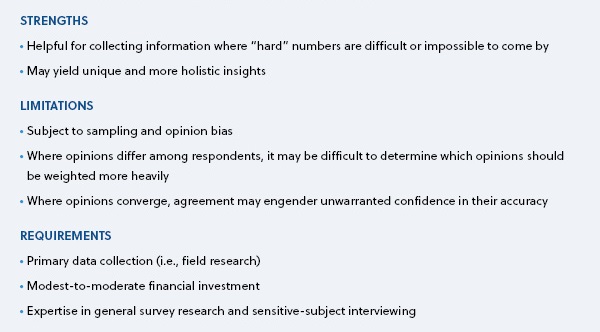

An advantage of expert and key informant surveys over population-based surveys is that they typically require a considerably less intensive investment in time and resources. The main limitation of expert and key informant surveys is that they rely on opinions likely to be of varying accuracy. Where estimates diverge considerably, determining which opinions to weight more heavily may be difficult and introduce the potential for further bias. Even the consensus-seeking Delphi method is not immune to this issue, as high levels of consensus may imply greater accuracy than is the case. Therefore, estimates derived from expert surveys should be cross-checked with estimates from other sources wherever possible.