What is the size and composition of the unrecorded market?

desk research approaches

What is the size and composition of the unrecorded market?

desk research approaches

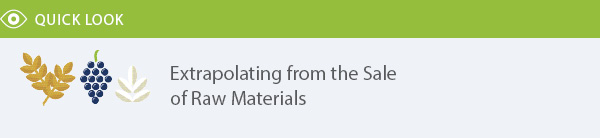

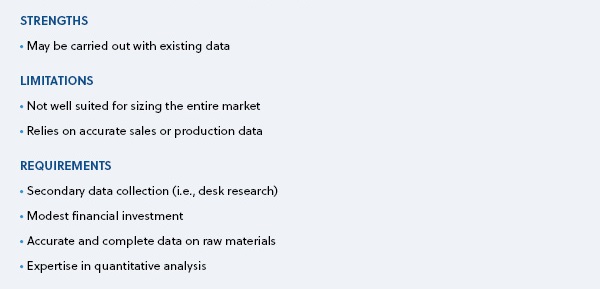

Extrapolating from the Sale of Raw Materials

Some studies have utilized data on the sale or production of raw materials ― such as sugar, grains, and fruit ― likely to be used for the home production of alcoholic beverages, as well as some illegal industrial production and refilling, to estimate the size of the unrecorded market. The primary limitation of this method is that it will not capture the raw ingredients for all unrecorded products, such as smuggled alcohol, surrogate alcohol, and alcohol purchased through legal cross-border shopping. Therefore, this approach is best when combined with other approaches, such as tracing ethanol through the value chain to capture other unrecorded products (see Value Chain Analysis), or in countries where homemade alcohol accounts for a very large portion of the unrecorded market. This approach is not recommended as a stand-alone approach for sizing the entire unrecorded market.

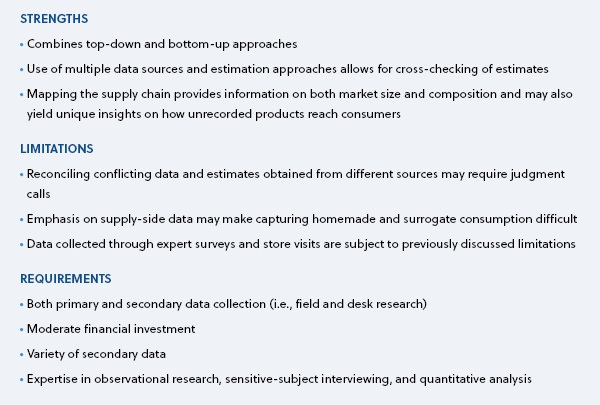

Extrapolating from Search and Seizure Records

Extrapolating from search and seizure records is another desk research approach that uses proxy measures to size the unrecorded market. In theory, because search and seizure data should include all categories of illicit alcohol, this approach may yield more complete data about the unrecorded market than the two previously discussed methods that extrapolate from raw materials or alcohol-related harms. However, in practice, this approach requires stringent laws, consistent and strict monitoring and enforcement, and robust records, whereas countries with large unrecorded alcohol markets typically have weak laws and / or enforcement and inconsistent, incomplete, or altogether non-existent records. Furthermore, licit unrecorded products are not captured by this approach. Thus, although search and seizure data may serve as an input to a more holistic approach to measuring the unrecorded market, it is not recommended as a stand-alone approach to sizing the market.